Why Another Market Crash Is Almost Guaranteed (And Why You Shouldn’t Worry)

Investors often fear market crashes, but understanding the bigger picture can help you navigate these turbulent waters with confidence. Let’s explore why market downturns are inevitable, why investing at all-time highs isn’t something to fear, and why many investors end up losing money despite strong market performance.

A Proven History of Market Resilience

Since 1928, U.S. markets have delivered an annualized return of nearly 10.5%. If you had invested $1 in 1928, that single dollar would have grown to $18,643 today. More recently, from 2009 to 2023, markets have compounded at an impressive annualized rate of nearly 15% — a result few would have predicted.

Yet, this incredible growth wasn’t without volatility. Market downturns, or intra-year drawdowns, are a normal part of investing. Since 1928, the average intra-year market drop has been 16.4%, even though the market ended the year positively 75% of the time. Focusing on more recent history (since 1980), the average intra-year drawdown is 14.2%.

The Painful Truth About Drawdowns

For those actively investing, drawdowns can be significant:

Since 1980: In 23 of the past 44 years (over 50% of the time), the market dropped 10% or more during the year.

From 2000 to 2023: The market experienced intra-year declines of 10% or more 58% of the time, including 8 years when the market dropped by 19% or more.

This chart comes from JP Morgan’s Guide to the Markets

For retirees, these downturns can be particularly nerve-wracking. Imagine retiring in 2000 with $1 million. Over the next 24 years, you would have experienced eight market drawdowns of at least $200,000. For larger portfolios, these drawdowns can be even more dramatic.

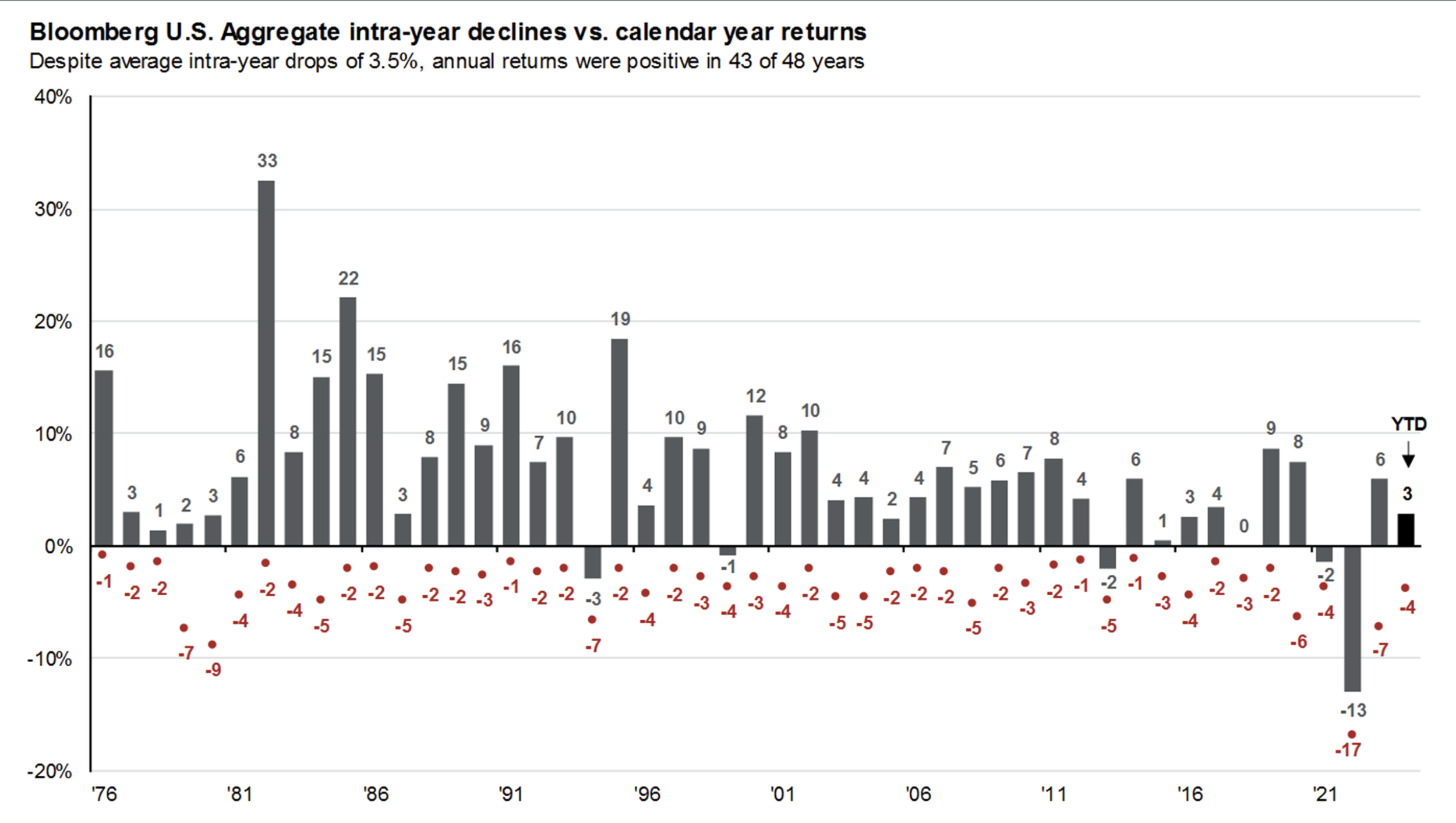

But, it’s not only equity markets that have this fluctuation.

While bonds are often seen as a "safe" investment, they are not immune to volatility. Bonds have experienced an average intra-year drawdown of about 3.5% over the past 48 years. Despite this, bonds delivered positive returns in 43 of those years.

This consistency highlights why bonds remain a crucial component of a diversified portfolio, especially for retirees looking for income and stability.

Unlike stocks, bonds tend to experience smaller and less frequent drawdowns. For example, during major equity market selloffs, bonds often serve as a buffer, helping to stabilize overall portfolio performance. This lower volatility can provide peace of mind during periods of equity market turbulence.

However, bond investors can still face challenges. Interest rate changes can lead to temporary declines in bond prices, particularly for longer-duration bonds. Despite this, the long-term trend for bonds has been overwhelmingly positive, reinforcing their role as a steadying force in a balanced portfolio.

Why Most Investors Lose Money

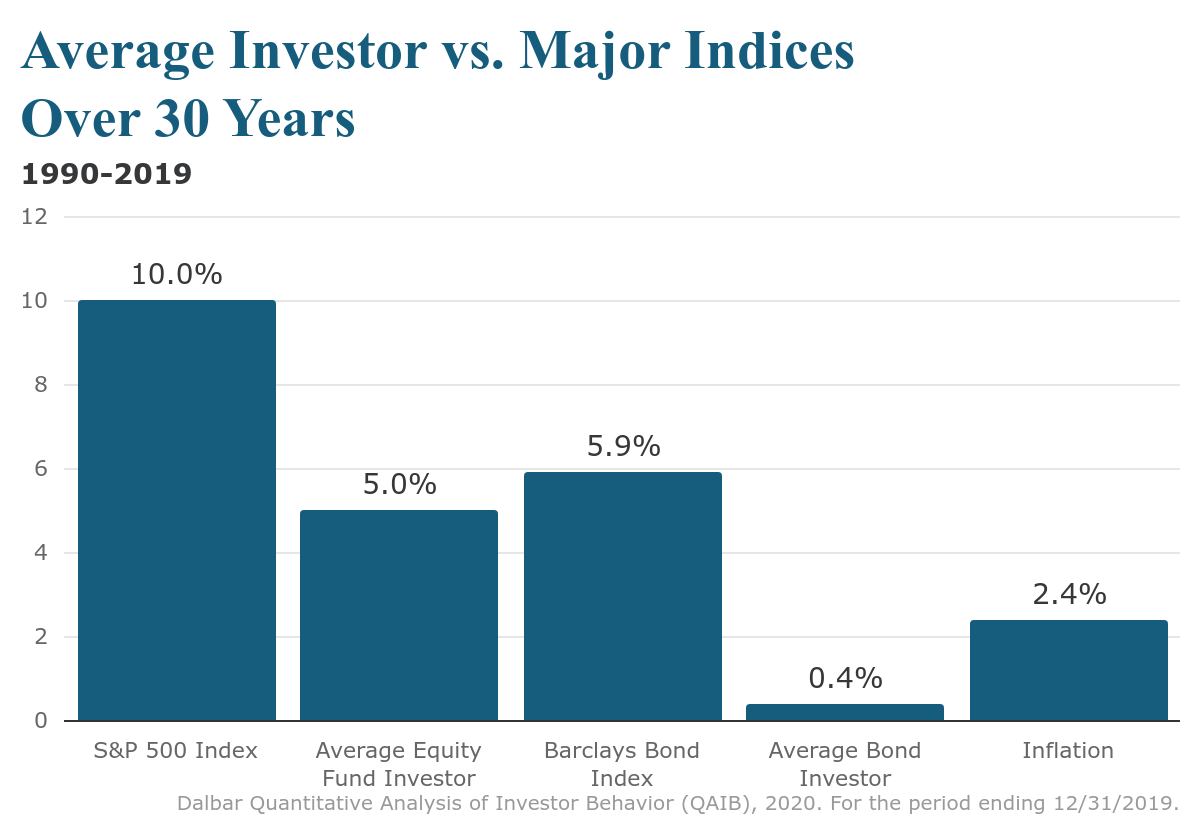

Peter Lynch, legendary manager of Fidelity’s Magellan Fund, delivered an astounding 29% annualized return from 1977 to 1990. Yet, the average investor in his fund lost money. Why? Investors often bought high during market rallies and sold low during downturns, locking in losses.

Dalbar’s research from 1990 to 2019 showed the S&P 500 returned nearly 10% annually, yet the average investor’s annualized return was just 5%. Even globally diversified portfolios (60% stocks, 40% bonds) averaged 8.72% annually during the same period, still far outpacing the typical investor.

This underperformance isn’t due to diversification. It’s emotional decision-making: fear prompts investors to sell during downturns, and greed pushes them to chase trends at the wrong time.

The Myth of All-Time Highs

Another common issue that causes investors to lose money is the fear investing at all-time highs, believing a market pullback is imminent. However, markets frequently reach new highs. In fact:

Over the past 10 years, there have been 300 new all-time highs.

On average, 7% of trading days since 1950 have resulted in a new all-time high, approximately one every 14 trading days. I’m grateful to a blog post from Ben Carlson for this data and the above chart.

Rather than avoiding the market, focus on building a diversified portfolio that aligns with your goals and risk tolerance.

Why Timing the Market Is a Mistake

Attempting to time the market often backfires. Emotional reactions — whether fear-driven selling or greed-fueled buying — can significantly harm returns. Staying invested and following a disciplined plan is the most reliable path to long-term success.

Market downturns are inevitable, but they’re also temporary. By focusing on the long term and avoiding emotional decision-making, you can navigate these periods without derailing your financial goals. Remember, successful investing isn’t about avoiding losses — it’s about sticking to your plan and staying the course.